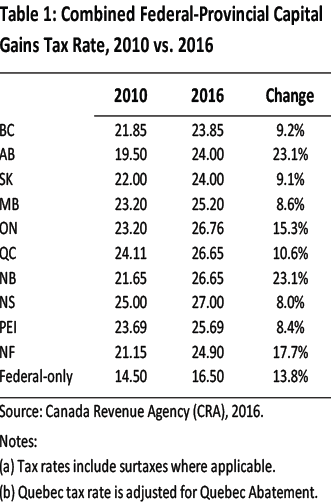

The interesting history of capital gains tax in Canada — and its significant impact on real estate | Financial Post

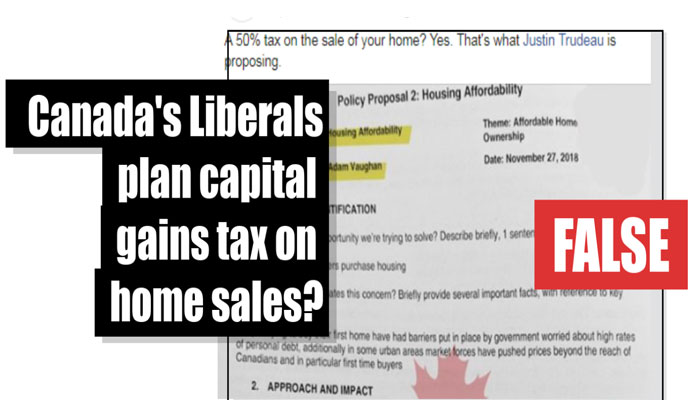

The Liberal Party's housing policy does not include a capital gains tax on primary home sales | Fact Check

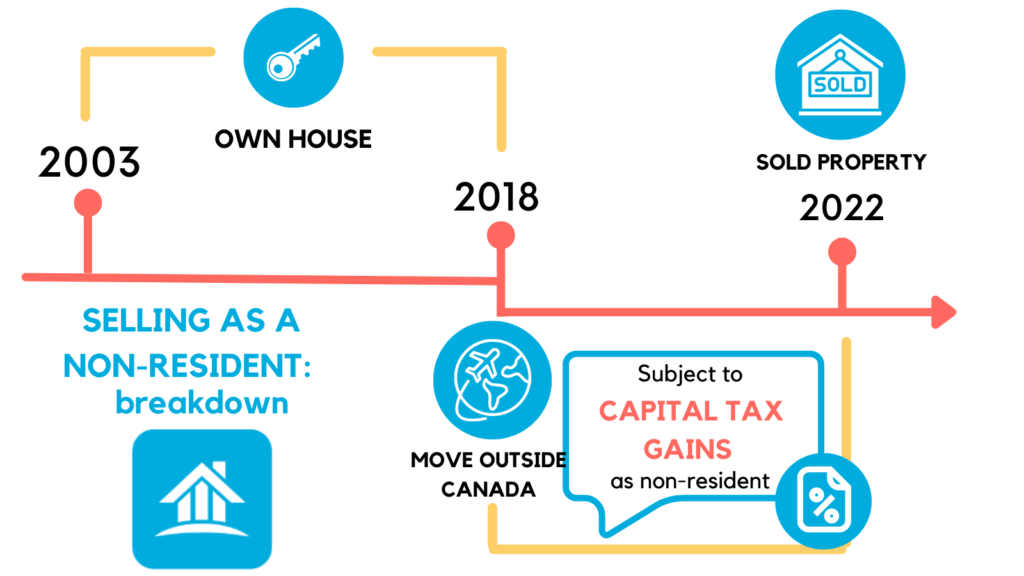

Leaving Canada and Selling Your Property: What You Need to Know - RankMyAgent - Trusted resource about Buying, Selling and Renting